Operational in over 200 countries with 25 currencies, PayPal is one of the largest third party digital financial services enabling users from all around the world to conveniently send and receive money online securely. It stores your payment information so that you don’t have to go through the hassle of entering the information everytime you need to shop online or send money to someone. Furthermore, PayPal ensures proper security and prevention of fraud so that no financial information is leaked to any unauthorized party.

PayPal is now being used worldwide by individuals, small businesses and major corporate industries. You can carry out several functions as a PayPal user:

- Transfer money from your bank account to your PayPal account and vice versa;

- Transfer money from one PayPal account to another;

- Buy or sell good and services; and

- Get a PayPal card to shop using your PayPal account.

Being the most popular choice for transfer of money, many major stores now accept PayPal as a preferred mode of payment including, but not limited to, eBay, Amazon, Target, and Samsung. Streaming apps like Netflix and Spotify also support PayPal for their monthly subscription payments.

PayPal has three apps which users can download based on their requirement:

The default PayPal app which is used for transferring and receiving money to family and friends;

The PayPal Business app, developed for business owners for buying and selling of goods and services as well as maintenance of accounts and invoices; and

The PayPal Here app, designed to work as a remote point-of-sale system.

How does paypal work?

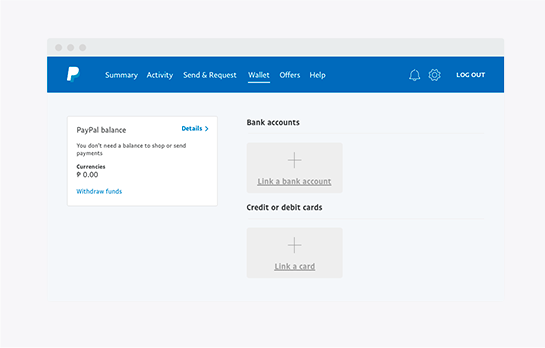

To transfer money using PayPal, it is mandatory for both parties to first create and set up a PayPal account. To set up an account, all you need to do is add an email address, decide on the type of account you want to create (personal or business), and add your bank account, credit or debit card details to set a default payment method. Once the verification and authentication process is complete, you can start transferring or receiving money to and from other PayPal accounts.

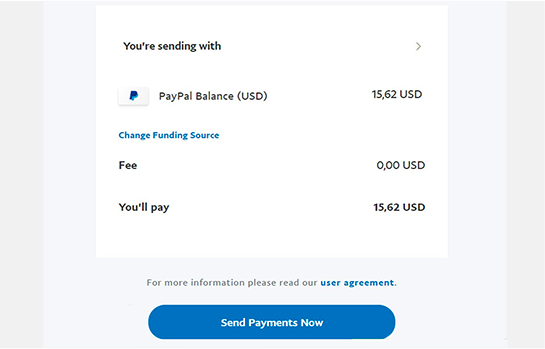

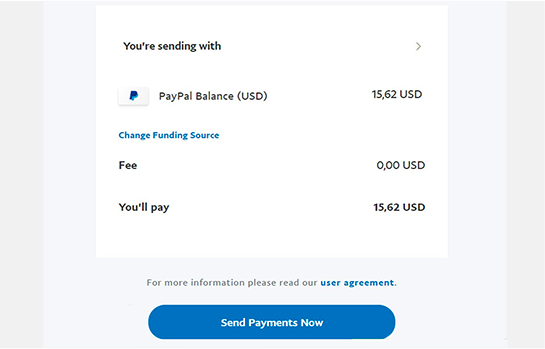

Users can use either PayPal’s website or their app to transfer money. Transactions are executed quickly, within a matter of minutes with PayPal ensuring that the money is available for withdrawal from the receiving end immediately.

PayPal is free for buyers but sellers have to pay a fee depending on their location and type of business. For example, in the United States, businesses using PayPal have to pay a flat rate of $0.3 along with 2.9% of the sale. Charities, however, have different rates; only 2.2% is charged.

There are several ways of transferring money using PayPal:

1. Basic transfer which is carried out using the money from the bank account linked to PayPal, free of cost. The amount is usually transferred on the following business day.

2. Instant transfer, where for a fee, you can transfer money and the account is credited in the receiver’s PayPal account immediately, which they can then move to their respective bank account.

3. eCheck which is similar to writing a check and can take three to five business days to clear.

PayPal for business

While PayPal is used to transfer money from one account to another, it can also be used by businesses, big and small, based on the features that it offers:

PayPal business app

This app, available on both Android and iOS, can be used by business owners to review their account activity, manage their funds, manage transaction history and overall finances.

PayPal business debit card

This card can be used instead of Visa or Mastercard and can also be used at ATMs to withdraw cash.

PayPal shipping

PayPal has a shipping service which provides discounts on delivery services such as USPS and UPS shipping labels. Furthermore, it enables users to track parcels through their PayPal accounts.

PayPal Invoicing

Invoicing through PayPal is quick and easy allowing for both ready-made and customizable templates for invoicing to customers through emails or a shared link.

PayPal Loans

PayPal offers two options for loan provision: PayPal Business Loan (ranging from $5000 to 500,000) and PayPal Working Capital (ranging from $1000 and $300,000).

What are the Benefits of Paypal?

Secure

PayPal functions to secure financial transactions by not requiring the sender and receiver to disclose their bank account or card details, thereby enabling users to safely carry out transactions. You can also make payments to websites without having to provide your credit card details and risk that information being misused.

To add another layer of security, PayPal allows users to enable a two step authentication process which generates a six-digit code whenever a user tries to log in. The code is sent to the user’s phone which they can then enter on the app or website to log into their account.

PayPal provides Purchase Protection to the buyer so that if the product is damaged or is not the one they ordered, PayPal will put a hold on the funds until the issue is resolved and will reimburse the purchase price as well as the shipping cost, according to the terms and conditions set for the transaction.

Fast Transactions

PayPal is the fastest way to transfer money, whether it’s for online shopping, to pay for online subscriptions or to pay money to a friend or family member.

Furthermore, there is no need to enter your financial information every time you need to send a payment. PayPal has the One Touch feature which keeps the user logged into a device for a limit of 180 days so that they do not have to keep on entering their information on different websites every time; the PayPal information will be saved for all websites supporting the software.

Cost-Effective

PayPal has no annual membership fees, no processing fees and no service charges, making for a cost-effective payment service in comparison to others. The only fee charged is based on the location and type of transaction taking place.

Multiple Setups

Multiple bank accounts, credit and debit cards can be set up to support the PayPal account so that there is no issue with a payment going through. Moreover, every PayPal account has a limit of 8 email addresses that they can add and link to a single bank account which makes it a convenience for money transfer as well as preventing unauthorized users from being able to hack into the account.

Available Online and Offline

PayPal is available both for online sales as well for in-person ones, making it a flexible choice. Small business owners tend to create websites using WordPress or Wix, both of which have the option of PayPal payment integration.

For in-person sales, PayPal has various Point of Sales (POS) solutions which include Touchpoint.io, BrightPearl, Touchbistro and ERPLY.

Discounts

PayPal offers discounts on various retailers. You can visit their offers and discount section where you can save on shipping costs for some retailers and avail discounts ranging from 10-50%.

How can we help you Integrate Paypal

In the current business climate, every business needs to have an online shopping system in place. With various financial services available, businesses, especially small startups, are not sure which one to go for. Our team will keep your business requirements and budget in mind before suggesting a payment integration solution that can be easily integrated with your business as well as enable your business to bloom and grow.

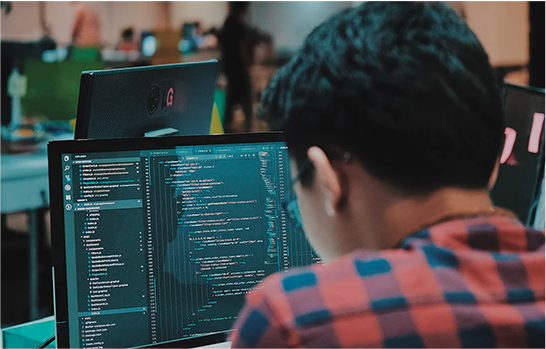

Our team at Winterwind offers PayPal integration services so that your website or shop can be integrated with the most effective payment service based on the requirements of your business. We can customize PayPal integration to optimize the PayPal platform in terms of mass payments, payment refunds, transaction searching and other financial functions.

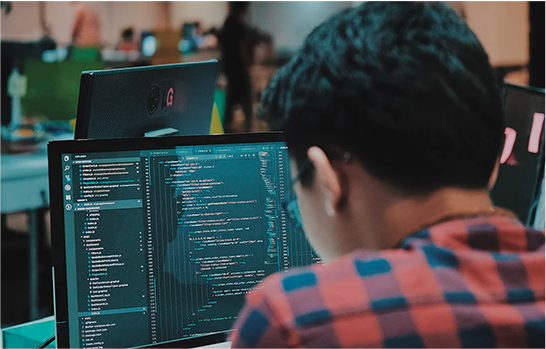

Integration development

Our development and integration team are proficient in the integration of PayPal REST API to incorporate functionality including managing secure transaction processing, recurring payments and direct payments. We are also equipped with the skillset to integrate PayPal with Hubspot, Mailchimp and Salesforce.

Payment processing solutions

Our team can provide solutions for your business to process transactions using bank accounts, cards and PayPal as well as PayPal Payments Pro and PayPal Express Checkout integrations.

Mobile app integration

We can develop mobile cart applications which can easily be incorporated with PayPal mobile SDK for Android, iOS and Windows OS.

eCommerce integration

This kind of integration will enable you to conduct online sales management operations smoothly. Our development team can create customized solutions with user-friendly interfaces which can be configured with accounting platforms like QuickBooks.

Other facilities that we provide include:

- Technical customer support service

- Increased flexibility with PayPal integration

- Fraud prevention systems

- Customizable features

We ensure that all PayPal integrations are secure by using the most updated security tools including PCI compliant integrations and SSL certificates.

Are you interested in integrating PayPal with your online business website or shopping cart? Or would like to know more about PayPal? Have a discussion with our lead consultant today!