What is Payoneer?

Founded in 2005, Payoneer is one of the most popular money transfer services, used globally by small businesses, startups and freelancers as well as tech giants including Google, AirBnB, Upwork, Shutterstock and Fiverr. Payoneer is fully operational in over 200 countries and transactions can be carried out in approximately 150 currencies.

Payoneer users can send and receive money into their bank accounts, Payoneer e-wallet or onto a Mastercard debit card to be used either online or offline. Payoneer is more useful for larger teams and for larger transactions because it has a minimum withdrawal amount of $20 and charges a $3 transaction fee for every withdrawal.

Payoneer’s cross border flexible financial service allows individuals, businesses and freelancers to pay and get paid worldwide. All you have to do is create a Payoneer account, which is free of charge and has no annual cost or maintenance fees. There is no prerequisite of opening a physical bank account in order to transfer money through Payoneer.

Payoneer has two types of accounts that you can create based on your requirements:

1. The first one has no annual fees and allows you to withdraw money from the Payoneer account directly into your bank account.

2. The second type includes the added feature of a prepaid Payoneer MasterCard and therefore has an annual charge of $29.95. This account is however only available to individuals and is not available to businesses.

Payoneer is used to carry out transactions, receipts and currency conversion for businesses and does not cater to individuals, therefore their features and services are different as compared to other money transfer platforms. It is most useful for IT, online marketing, eCommerce and outsourcing companies and the staff that work for them.

How does Payoneer Work?

To transfer money using Payoneer, you must first create a Payoneer account. There is no setup cost, and it is free for all users. You will need to determine if your account is to be used personally or professionally, and will then be requested to enter your personal details including your name, email address and contact details. After the verification process is done, you can add your bank and card details. Payoneer will perform a credit check which can take up to 2-3 business days. After approval, you will receive the Payoneer Master card, which you can activate, and will then be eligible to receive money from over 200 countries in the world. After you have been paid you can withdraw the funds to your local bank account.

Payoneer provides a variety of services:

Receiving International Payments

Through Payoneer, millions of users transfer and receive money globally every day. The Payoneer account basically acts like a normal physical bank account so receiving money through Payoneer will basically work like a bank transfer. You can provide your Payoneer details to your employer or customer and they can conveniently send you the payment without any hassle. Furthermore, Payoneer also provides the feasibility of being paid online using credit/debit cards or bank transfers, providing a simple and quick solution globally to send and receive money.

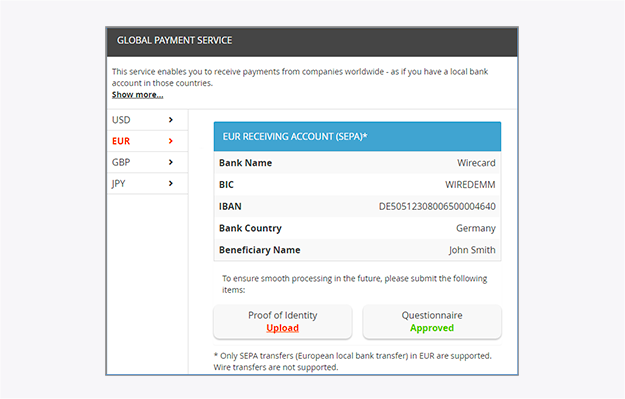

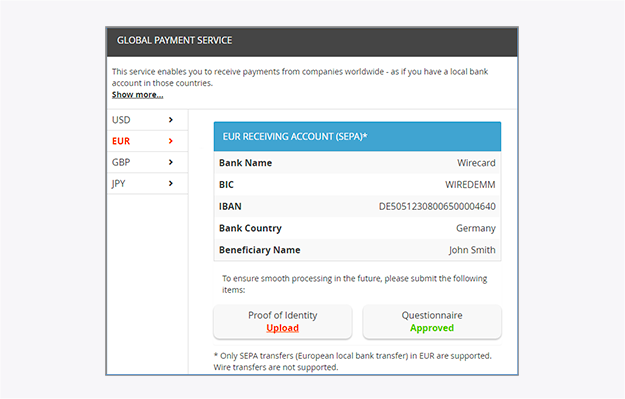

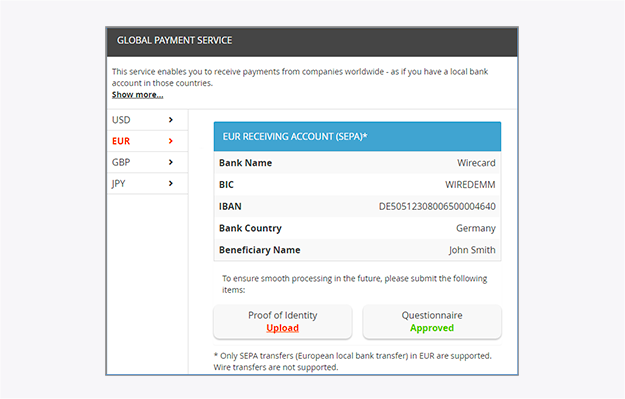

Another feature of Payoneer, known as the Global Payment Service,

enables users to create receiving accounts for commercial payments in Euros, Dollars, British Pounds and Japanese Yen which can then be converted to a local currency.

Easy Access to Funds

After receiving your money, there are numerous ways to withdraw or spend your money:

Transfer to a local bank account

You can transfer your money from the Payoneer account to your local private or business bank account in a local currency, saving on international transfer processing fees.

Carry out a transaction

You can minimize transaction fees by making payments to vendors or customers through your Payoneer account. Transfers between two Payoneer accounts are completely free.

Payoneer MasterCard

Payoneer MasterCard works in the same way as a normal credit card works; you can use it to withdraw cash from an ATM, or to make purchases online or in stores.

Payoneer Fee Structure

Payoneer has different types of fees for different types of transactions as mentioned below:

| Action |

Free Structure |

| Account Setup |

Free |

| Receiving payments from a Payoneer account |

Free |

| Receiving money into local account using Global Payment Service |

Free for EUR, GBP, JPY, AUD, CAD and CNY0-1% fee for USD |

| Receiving money through credit/debit card |

3% fee |

| Receiving money through eCheck |

1% fee |

| Receiving money from marketplace |

Fee determined by each respective marketplace |

| Currency exchange |

2% fee above the interbank rate |

| Withdrawing funds to local bank account in different currency |

$1.50, €1.50 or £1.50, application to transfers from USD, EUR or GBP receiving account to local bank account |

| Withdrawing funds to local bank account in different currency |

2% fee above the interbank rate |

| Purchase using Payoneer card in a different currency |

3.5% currency conversion charge |

payoneer_integration.Other fees depend on the bank

Why Should You Use Payoneer?

There are many benefits of choosing Payoneer as your go-to option for financial transactions:

Global Coverage

Payoneer has an extensive network, being functional in over 200 countries and operates in approximately 150 currencies.

Signup Bonus

To encourage new account holders to select Payoneer as their financial transaction service, it offers a $25 bonus within the first 7 days of receiving $100 from any Payoneer based company.

Safe and Secure

Transferring money using Payoneer is safe and secure, and the platform ensures that no unauthenticated user can have access to any user’s information.

No Bank Account Needed to Create an Account

Instead of having a bank account, Payoneer provides a MasterCard to its users who can then use the card for either purchasings goods and services, or use it in their local ATMs to withdraw cash. There is no requirement of making a bank account to create a Payoneer account.

Receive Payments Quickly

Using Payoneer can enable you to receive payments quickly, with the time ranging from five minutes to a few hours. No Hidden Costs - Payoneer is extremely transparent about the transaction fees and taxes that it charges. Moreover, the Payoneer MasterCard has a lower operating cost as compared to other credit card processing fees.

Integratable With PayPal

Payoneer can easily be integrated with other payment platforms like PayPal which will enable you to link your Payoneer MasterCard and bank account with PayPal if you reside in a country where PayPal is available.

Multi-Lingual Support

The Payoneer website supports 8 languages other than English, including Spanish, Vietnamese, Arabic, Korean, Russian, Chinese, Ukranian and Japanese, enabling non-English speakers to easily navigate through the website or app.

Good Customer Service

If you’re facing any problems with your Payoneer account or with transferring money, their customer service is extremely quick. They also have FAQs available on their website to assist with any problems that might come up.

Why Should You Choose Winterwind For Payoneer Integration?

In this advanced age of digital technology, it becomes mandatory for every business to have a digital financial and payment service in place. Winterwind’s team of experts can assist you in the integration of Payoneer to enable you to pay your employees, send payments to your vendors or send refunds to your customers.

We offer Payoneer integration services so that your website or shop can be integrated based on the requirements of your business, allowing you to programmatically send payments according to different events within your business or application.

We can assist you in the seamless integration of Payoneer APIs on all supportable devices including Windows, Android, Apple and web, which will enable you to send and receive payments quickly. Whether you are a small business owner or a large corporate industry director, we can offer Payoneer integration services to allow you to carry out the following tasks (and automatically):

- Sell products or services through your website or social media with Payoneer;

- Send bills and invoices to customers and vendors anywhere in the world;

- Transfer funds from your Payoneer to your local bank account in your local currency;

- Set up automated monthly payments for your local and international employees, contractors and freelancers;

- Enable you to have specific currencies required to carry out transactions in different parts of the world; and

- Allow you to view and manage your financial activity on all your online and offline stores on one single platform through Store Manager.

Our development and integration team are proficient in the integration of Payoneer Api formatted in order to integrate functionality including but not limited to secure and safe transaction processing and recurring weekly and monthly payments.

Our team also specializes in incorporating mass payout APIs to ensure complete automation of payment initiation for a larger number of transactions while also making sure that the process is completely transparent. This integration can enable you to make up to 500 payments using just a single API.

Furthermore, we are pros at the interface implementation in order to maintain PISPs (Payment Initiation Service Providers) and AISPs (Account Information Service Providers) so that they can capture information so that PSUs (Payment Service Users) can securely have authorized access to the payment services. They can then withdraw to their local bank account, send payments to Payoneer and other accounts and track payment status, while also being able to view their account balance and transaction history.

Other Payoneer-related services that Winterwind provides include:

- Technical customer support service

- Increased flexibility with integration

- Fraud prevention systems

- Customizable features

Most importantly, we work hard to ensure that all Payoneer integrations are end-to-end secure, by incorporating the most relevant security tools and technology including PCI compliant integrations and SSL certificates so that no unauthorized user can access any account.

Are you interested in integrating Payoneer with your online business website or shopping cart? Would you like to get more information on how Payoneer works? Have a discussion with us today. We would love to help you out!